I’ve always considered myself a “math” guy. I love logistics, patterns, deductions, puzzles, etc. Math and numbers were always just something that came easier to me than other people it seemed. I reference this to justify my success in music and technology/computers. I even feel like it has helped me to be a better designer.

There is one caveat. I have to admit that I am not good with money. At all.

There’s a tinge of me that feels like it’s intentional (plugging my ears and saying “la, la, la” when there’s an opportunity to make a sound financial decision). But regardless, it is gut-wrenching to come face-to-face with knowing that I have made bad financial decisions throughout the last decade and the “what if” of hindsight.

And it wasn’t without attempts to plan ahead. I even spent too much on fancy high-profile financial planners which ended up costing me more than I made off of their advice.

I have a family, and a child now, so it’s time to make some solid, future-proof decisions without spending all day and night on speculation.

Now we all know that building up a 401k is a SMART move. You save extensively on taxes, and it is one of the most cost-efficient ways to build a savings cushion for retirement or other future goal. But 401K’s aren’t meant to just sit and fester. They need nurturing, analysis and quick action to maximize returns. In the past, that planning would costs thousands of dollars on a regular basis.

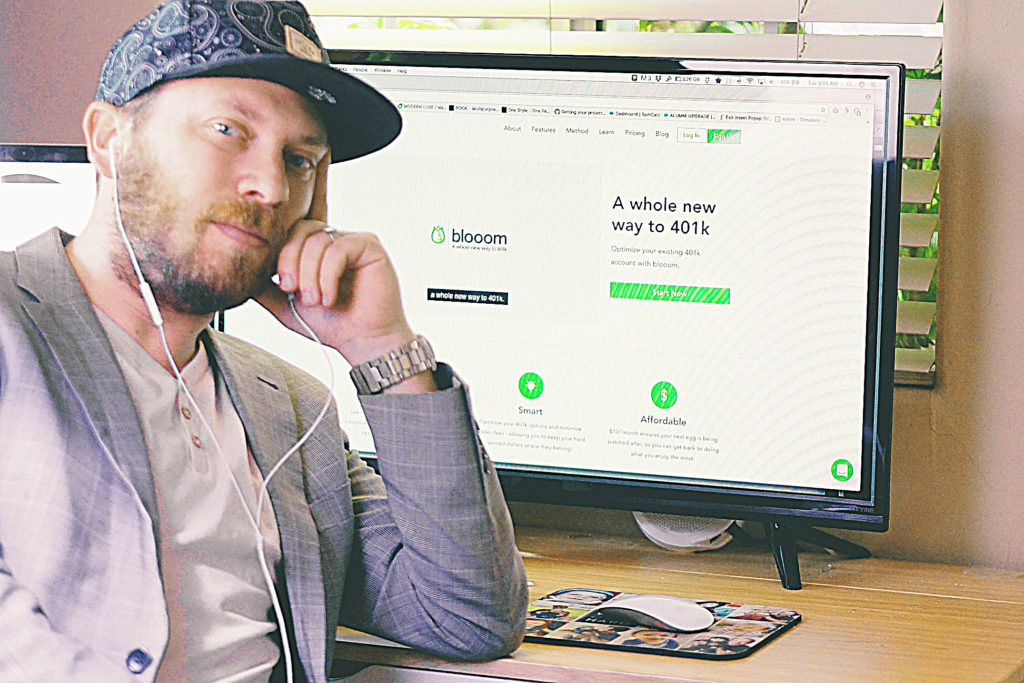

But that’s where blooom comes in.

Straightforward, clean 401K analysis, advice and management for only $10 per month. blooom will make sure you have the right mix of investments, inform you on what you’re invested in, and even rebalance your account regularly to minimize fees and maximize returns.

If you have a 401K that you’ve ignored, take blooom’s free assessment to find out the current state of your retirement plan. If you don’t have one, go get one – like I plan to do – and start looking forward for your family and your retirement.